How Rising Mortgage Rates are Influencing the UK Property Market

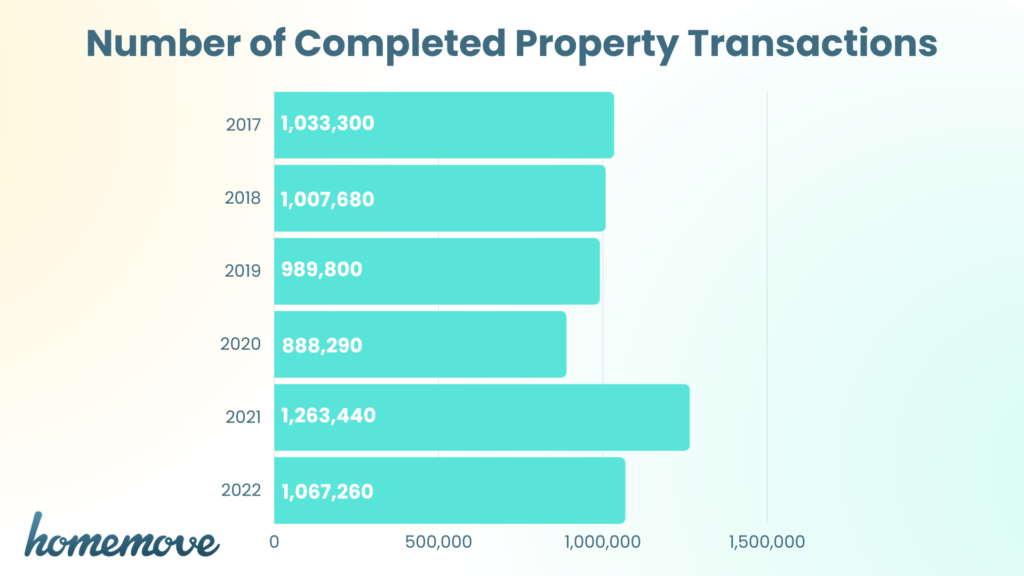

Well, it seems we are set for an interesting ride in the UK property market over the next year or so. Recent research from Zoopla predicts a drop in housing sales by 21% in 2023 compared to the sales in 2022. Now, if you’re feeling a touch of déjà vu, you’re not alone. These numbers take us back a decade, as it’d be the lowest number of sales since 2012. So, what’s fuelling this trend you ask? Well, folks, it all comes down to rising mortgage rates.

Diving Deep into Zoopla’s Research

Zoopla, a trusted name in property analytics, recently released some compelling findings, captivating industry enthusiasts and stakeholders alike. The central revelation from their extensive research? A predicted 21% drop in housing sales for the upcoming year compared to the current year. Such a forecast hasn’t been witnessed in a while, stirring discussions across various platforms.

This significant dip is not merely a statistical anomaly. It underscores deeper market dynamics and patterns. Reflecting back, one would need to go as far as 2012 to find a year with similarly subdued housing sales figures. That’s nearly a decade of consistent growth and relative stability, now seemingly upended.

Delving further, it becomes evident that underlying factors are at play. External pressures, changing economic circumstances, and evolving buyer sentiments might be contributing. But the primary question that looms large: What are the broader ramifications of this shift? And how will it redefine the landscape of the UK property market in the subsequent years?

Rising Mortgage Rates: The Prime Mover

The precipitous drop in housing sales begs the question: What’s driving this downturn? The culprit, it turns out, is the escalating mortgage rates. These rates, often reflective of broader economic health, can be both a barometer and an influencer of property market vitality. They directly affect a plethora of aspects like a buyer’s financial reach, the overall market appetite, and eventually, transaction numbers. Higher rates equate to amplified monthly payments, stretching budgets and pushing the dream of owning a home further away for many.

Interestingly, these rising rates herald a recovering, resilient economy. But while this may sound like good news for some sectors, for potential homeowners, it’s a bitter pill. The added financial burden can be daunting, especially for first-time buyers or those with tighter budget constraints.

Now, delving into the nuances, it’s worth noting that the impact isn’t uniformly spread. Cash transactions, representing a smaller segment of the market, are forecasted to dip slightly by just 1%. In stark contrast, properties purchased through mortgages face a steeper decline, highlighting the direct mortgage rate impact. This shift creates an intriguing dynamic, tilting the property market’s scale and reshaping the usual buyer profiles we’ve become accustomed to.

Such disparities underline the necessity for both buyers and sellers to stay informed. Understanding these rate-driven trends can guide decisions, whether it’s timing a purchase or setting a property price. As mortgage rates continue their ascent, their ripple effects on the UK property landscape will be worth monitoring closely.

The Shift Between Mortgaged and Cash Sales

The dynamics between cash and mortgaged sales offer a fascinating study in market behaviour. When mortgage rates rise, the entire purchasing equation changes. For many aspiring homeowners, the dream often starts with a mortgage application. However, with escalating rates, this pathway becomes riddled with financial strain. Borrowers face not just the principal amount, but a considerably higher interest over the loan’s lifetime. This often translates to bigger monthly repayments and a more extended debt period.

Given the financial implications, many potential buyers find themselves at a crossroads. Do they dive in, accepting the heavier burden, or wait, hoping for a future rate drop? This hesitation leads to a noticeable slowdown in mortgaged property sales. It’s a protective move, safeguarding personal finances against potential market volatility.

On the flip side, cash buyers emerge as the market’s silver lining. Unburdened by loan constraints or rising interest rates, they manoeuvre with more agility. Their unaffected purchasing power, combined with reduced competition, positions them as coveted buyers. Property sellers, aware of the market’s tilt, may be more inclined to make concessions or offer better terms to secure a deal. It becomes a seller’s imperative to appeal to this cash-rich segment, redefining strategies and expectations.

In essence, the interplay between cash and mortgage sales isn’t just about numbers. It’s a reflection of buyer sentiment, financial strategy, and market adaptability. As these forces interact, they shape the property landscape, dictating trends, prices, and opportunities.

The Larger Implications

The evolving dynamics of the UK property market, driven by shifts in mortgage rates, paint a picture of a bifurcated landscape. On one side, there’s the cash-rich segment, unfazed by rate fluctuations, moving with confidence. Conversely, the other side sees potential homeowners grappling with the tangible effects of these rate hikes, making strategic decisions on property investments.

This emergence of a two-tier market does more than just segment buyers. It can influence property valuations, the rate at which properties change hands, and even dictate the types of properties that see higher demand. For instance, prime properties in sought-after locations may become more accessible to cash buyers, while properties typically favoured by first-time buyers might see reduced demand.

But how does one decipher if this shift is beneficial or detrimental? The truth lies in perspective. For cash buyers, it might mean better deals and less competition. For sellers, it might necessitate more flexible pricing strategies to attract a broader audience. And for mortgage-bound buyers, it could mean waiting on the sidelines or reconsidering property aspirations.

For those deeply entrenched in the property sector, be it as agents, investors, or regular buyers, staying updated is paramount. Knowledge becomes the compass guiding decisions in this ever-changing landscape. Monitoring mortgage rate trends, understanding buyer behaviours, and recognising market nuances will equip individuals to make informed choices.

Remember, much like the unpredictable winds on the open sea, market forces can change direction swiftly. To thrive, one must be prepared, adaptive, and keen-eyed, ensuring that every decision made aligns with both current trends and future projections. And as the age-old adage goes, it’s not about waiting for the storm to pass but learning to dance in the rain. To be prepared use homemove we can help you compare mortgages here.

So, as you embark on your property journey, amidst the ebb and flow of rates and trends, may you find the perfect haven you seek. Best of luck, and until we delve into the market’s mysteries again, happy hunting!

Original Article:https://www.propertywire.com/adviser-news/buy-to-let/mortgage-rate-hikes-will-push-home-sales-to-11-year-low/