The Future of Britain’s Housing: Lifetime Renting on the Rise?

The landscape of the UK property market is undergoing a significant shift, with an increasing number of individuals facing the prospect of lifetime renting. As house prices continue to skyrocket, getting a foothold on the property ladder has become a seemingly insurmountable challenge for many. Reports predict that we may see a million or more retirees still paying rent in the UK. This is a thought-provoking trend with far-reaching implications for future generations.

A Snapshot of the New Trend: Lifetime Renting in the UK

Recent industry data suggests a growing number of people may enter retirement as lifetime renters, never having owned a home. A combination of factors, including rapidly increasing house prices, stagnant wages, and challenging market conditions for first-time buyers, are steering this shift. The dream of homeownership is becoming increasingly elusive, making lifetime renting a reality for many.

Unraveling the Factors Behind the Rise in Lifetime Renting

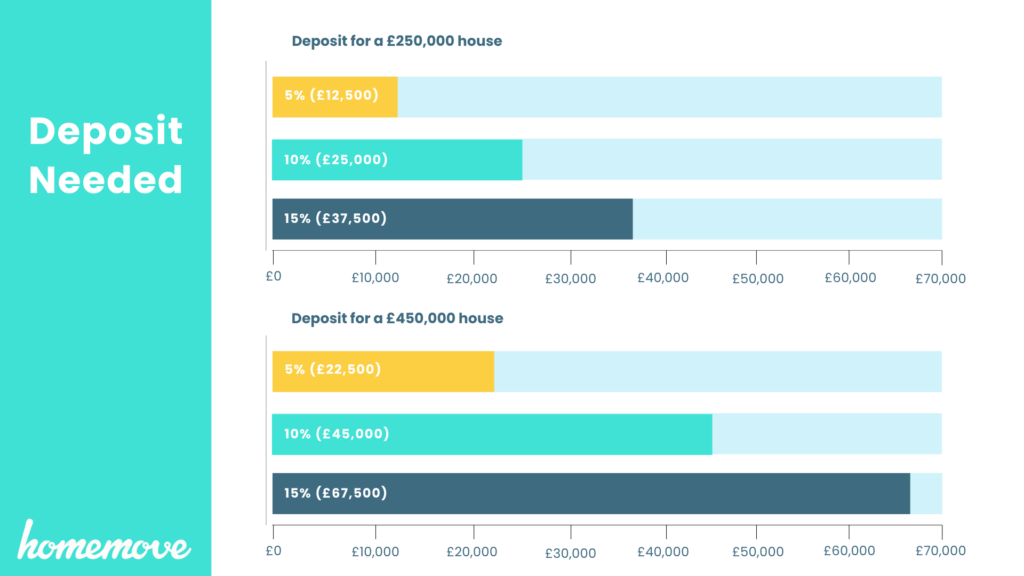

Several key drivers contribute to the growing trend of lifetime renting. Among these, the surge in house prices is a leading culprit. Coupled with wage stagnation and higher living costs, it becomes a Herculean task for many to accumulate the sizeable deposit needed for a house. Take a look below at the deposit you would need for a house worth £250,000 and £450,000. We cover in our blog here more detail about the deposit needed if you would like to read more.

The Struggle Against Rising House Prices

Over the past few decades, we have witnessed a drastic escalation in house prices across the UK. This steep increase has put homeownership out of reach for many potential buyers, leading to a rise in lifetime renting. The most significant impact is observed among the younger generations who are finding it especially tough to get on the property ladder.

Stagnant Wages and Increased Living Costs

While house prices have soared, average wages have not kept pace, creating a widening affordability gap. Additionally, the cost of living continues to rise, further straining the finances of those aspiring to buy a home. This economic climate has forced many individuals to opt for lifetime renting, as accumulating a down payment becomes an increasingly distant dream.

The Implications of Lifetime Renting for Retirement

The prospect of renting throughout retirement is daunting. Lifetime renters may face financial instability in their golden years, as their pension or savings may not suffice to cover escalating rental costs. This uncertainty could significantly impact retirees’ quality of life and necessitate downsising or relocating to more affordable areas.

Navigating the UK Property Market: Tips and Advice

Despite the grim scenario, there are potential solutions and strategic moves to make homeownership a reality. Government schemes like Help to Buy, Shared Ownership, or the Lifetime ISA can assist first-time buyers. Strategic financial planning, including early savings for a deposit, can be a game-changer in securing a home. Alternative housing options, such as co-living or moving to more affordable locations, could also be worth considering.

The Importance of Early Planning for Future Security

These shifting trends underscore the importance of early and strategic planning for securing housing for retirement. Decisions made during our peak earning years can greatly influence our retirement housing situation. For those concerned about falling into the trap of lifetime renting, consider long-term planning regarding your property goals, and remain informed about market trends.

Conclusion

In conclusion, while the rising trend of lifetime renting presents significant challenges, with the right planning and strategic use of available resources, it is possible to navigate the UK property market successfully. Let’s face it together and turn this challenge into an opportunity for a secure future.

Original Article: https://www.telegraph.co.uk/property/renting/one-million-face-renting-in-retirement-property-ladder/