The Unprecedented Surge in Rental Prices: A Closer Look at London and the South East Property Market

The property landscape of Greater London and the South East is undergoing a transformative phase. In recent times, these regions have witnessed a striking and unanticipated rise in rental prices, setting fresh records that have captured the attention of investors, renters, and market analysts alike. This surge, unexpected especially in the backdrop of economic uncertainties post-pandemic, has left many questioning its origins and sustainability.

This sudden boom stands in stark contrast to the relatively stagnant period observed since the onset of the pandemic. While some attributed the earlier sluggishness to the economic repercussions of COVID-19, the resilience of the property market has shone through with this recent uptrend. The dynamics leading to this sharp escalation are multifaceted, ranging from pent-up demand and changing housing preferences to broader economic recovery and strategic investments. This article delves deeper into the causes and implications of this rental price surge, aiming to provide clarity amidst the prevailing market speculations.

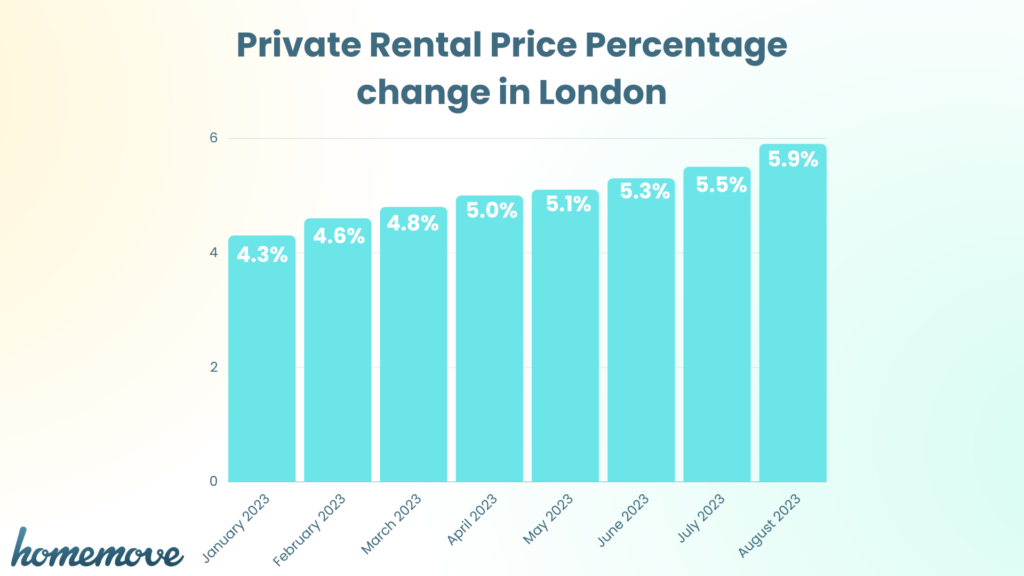

The Current Scenario in London’s Rental Market

The bustling streets of London, often regarded as the heart of the UK’s property market, have been buzzing with conversations around the monumental shifts in its rental space. September, in particular, proved to be a watershed moment. Tenants across the capital are now grappling with a heightened average rental cost, which stands at a staggering £2,275 per property. For those keeping a close watch on their finances, this essentially means shelling out over £200 extra every month, translating to an astounding 6% month-on-month increase.

This recent spike is not just another statistic; it has set a precedent in the annals of London’s property market. Surpassing the £2,200 mark is no minor feat, especially when considering this figure was once deemed a near-unreachable threshold for average rentals in the city. The once perceived glass ceiling seems to have shattered, making room for new benchmarks and redefining the city’s property narrative. Experts and stakeholders are now left wondering: what catalysed this leap, and more importantly, is this the precursor to an even steeper ascent in the coming months?

The South East Riding the Wave

While London’s skyrocketing rental prices have grabbed many headlines, the South East isn’t trailing too far behind. This region, with its rich history, vibrant communities, and proximity to the capital, has traditionally been a sought-after residential spot. Recent months, however, have seen an even more heightened interest, reflected in the swelling rental prices.

The diversity of the South East means that not all areas have seen uniform hikes. Some coastal towns, for instance, have recorded more modest increases compared to affluent suburbs closer to London. Yet, the overarching theme remains: there’s a tangible, upward shift across the board. This isn’t merely a standalone phenomenon. Analysts point to London’s booming rental market as a significant influencer. As prices in the capital soar, it pushes a segment of renters to explore alternatives in the peripheries, inadvertently driving up demand, and subsequently, prices in the South East.

Moreover, the South East’s appeal isn’t solely based on its cost-effectiveness. The region offers a blend of urban conveniences and scenic landscapes, making it an attractive proposition for many. As a result, as London’s rental prices continue to climb, the South East finds itself in a unique position, both as a beneficiary of overflow demand from the capital and as a region with its intrinsic allure.

Factors Behind the Rental Surge

The rapid growth in rental prices can be attributed to a blend of market, economic, and societal factors. Here’s a concise breakdown:

Property Market Dynamics: As property sales prices rise, it’s typical for rents to follow. Limited housing stock has further intensified this trend, driving both sales and rental prices upwards.

Economic Recovery: Post-lockdown economic resurgence has reignited employment opportunities and consumer confidence, amplifying demand in the rental sector.

Post-Pandemic Living Needs: With more people working remotely, there’s a heightened demand for spacious living and work environments, nudging renters to invest more in their accommodations.

Government Interventions: Initiatives like the stamp duty holiday, though designed for buyers, created ripples in the rental market due to the general uplift in property sector sentiment.

Implications for Renters

As the rental market rapidly shifts, renters are faced with tough challenges and consequential decisions. With mounting costs, particularly pronounced in London and the South East, many are re-evaluating their living priorities. While some stretch budgets, others reconsider amenities or desired locations. The widening gap between wages and rents has prompted crucial discussions with landlords, with many renters either seeking rent reductions or contemplating relocation. The evolving work-from-home culture further complicates matters, as renters weigh the premium of city living against the flexibility of remote work. In essence, this surge is significantly reshaping renter behaviours and priorities, creating a multifaceted rental landscape.

Viewing the Market in a Broader Context

The remarkable surges in rental prices observed in London and the South East naturally raise broader questions about the UK’s property market as a whole. Is this trend an isolated incident confined to these regions, or does it hint at a more comprehensive shift in the UK’s housing dynamics? Historically, London has often been the bellwether for the UK property market, setting the tone for national trends. Factors such as the influx of international investors, regulatory changes, and economic stimuli often play out first in the capital before rippling outwards. The ripple effect can be seen in how commuter towns and more distant regions adjust their prices in response to London’s market. Therefore, the prevalent scenario in London and the South East might not just be a regional story but a precursor to a larger narrative about the future direction of the UK’s property market.

Stepping into the Future

It’s indeed a dynamic era for UK’s rental market, especially for London and the South East. And while this surge brings about challenges for the renters, it also opens up new possibilities within the market. A question worthy of contemplation is whether these trends will persist and shape the new norm, or if they emerge as temporary ripples soon to smoothen out. Well, as they say in the property market, the only constant is change!

Original Article:https://www.propertywire.com/adviser-news/buy-to-let/london-south-east-rents-surge/