UK Property Evolution 1988-2023: The £150,000 Enigma

From the perspective of the UK Property Evolution 1988-2023, £150,000 in 1988 stood out as a significant sum. Back then, it embodied dreams of sprawling estates and prime addresses. Now, the narrative has dramatically shifted. This piece delves deep into the transformative journey of what £150,000 once represented and its diminished potency today.

With the UK property evolution 1988-2023 in view, it’s a fascinating exploration of market dynamics, inflation, and societal change. Our expedition delves into transformations, market trends, and the evolving definition of value within the property sphere. Strap in for a trip down real estate memory lane!

The Property Market in 1988

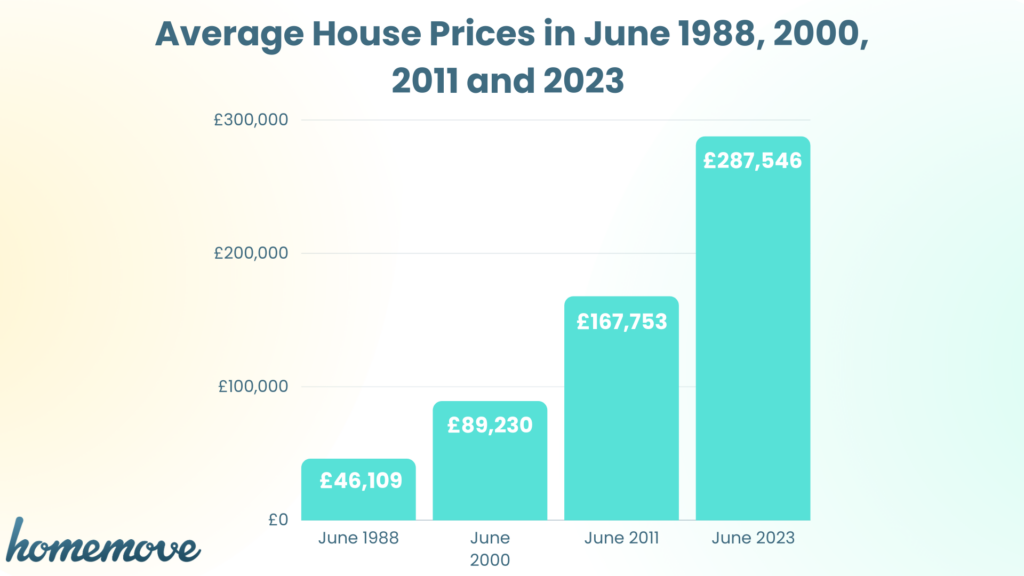

In 1988, the UK property landscape was significantly different. Journeying back to this era, £150,000 wasn’t just substantial; it was transformative. This sum surpassed the national average house price, being nearly three times its value. In a market where the average flat fetched around £285,000, possessing £150,000 elevated your status. Potential buyers wielding such an amount often found themselves in the spotlight, akin to property royalty.

Diving into London’s heart, the scenario was even more pronounced. In renowned boroughs like Knightsbridge and Belgravia, £150,000 surpassed the average home cost by about a third. Such an amount opened doors to properties in some of London’s most coveted neighbourhoods, laying the foundation for solid future investments.

UK Property Evolution 1988-2023: The Buying Power of £150,000 in 1988

Delving into 1988’s property scene, many wonder about the real power of £150,000. For context, imagine a chic one-bedroom flat nestled in Chelsea’s vibrant streets. Picture a generous three-bedroom maisonette, boasting modern aesthetics in Holland Park. That was the allure of £150,000 back then, offering diverse property options.

Going beyond standard urban dwellings, £150,000 also presented luxuries few could dream of. Imagine owning a sprawling 47-acre deer park complemented by a majestic five-bedroom residence. It’s a fantasy for most but a reality with that sum in 1988. For those favouring multiple investments, the same amount could secure 11 two-bedroom homes in Hull, setting the stage for a mini property empire.

Contrastingly, today’s landscape tells a different story. The average house price in Kensington and Chelsea now touches a staggering £1,275,716, showcasing the profound changes in the UK property evolution from 1988 to 2023.

UK Property Evolution 1999-2023: The Diminished Power of £150,000 Today

Fast-forwarding to today’s housing scene, £150,000 paints a starkly different picture. Once, this sum opened doors to myriad property dreams. Now? It feels like those doors have slightly narrowed. Comparing the buying potential between 1988 and today is like juxtaposing mountains with molehills.

This jaw-dropping contrast isn’t just a matter of inflation. It highlights deeper market dynamics at play. While £150,000 once signalled luxury or expansive choices, today it offers modest, sometimes restrictive options. Such is the profound shift in the UK property evolution from 1999 to 2023.

For many potential homeowners, this realisation can be jarring. The majestic properties of 1988, which once felt within reach with £150,000, now seem distant dreams in today’s competitive market.

UK Property Evolution 1999-2023: Navigating the Property Market’s Sea Change

The vast expanse of time reveals the UK property market’s drastic shifts. Three decades have altered the essence of what £150,000 can acquire. From luxurious dwellings in the past to modest accommodations today, the journey is enlightening.

Consider this: £150,000, once a king’s ransom, feels diminished today. This stark transformation isn’t solely a UK phenomenon. Globally, wage growth lags behind the escalating property prices, creating wider chasms for potential homeowners.

Such changes aren’t just financial but emotional too. Homes once viewed as palatial now seem modest. The once commanding power of £150,000 now feels more like spare change in the UK’s evolving property landscape.

Our hopes? A return to a market that favours both buyer and seller, reflecting the balanced dynamics of yesteryears. The golden era of 1988, where every penny had pronounced value, remains a dream we cherish.

Original Article:https://www.theguardian.com/money/2023/aug/20/from-the-observer-archive-what-could-you-get-for-150000-pounds-in-1988