The cost of moving house in the UK rises year on year. What are the different costs involved that you will need to take into consideration when working out your budget? The main costs of moving house are:

- Estate agent fees

- Conveyancing fees

- EPC fees

- Removal costs

There also may be additional costs such as:

- Mortgage exit fee (early repayment charge)

- Preparing the property for sale

- RICS survey

- Redecoration/ snagging

Estate agent fees

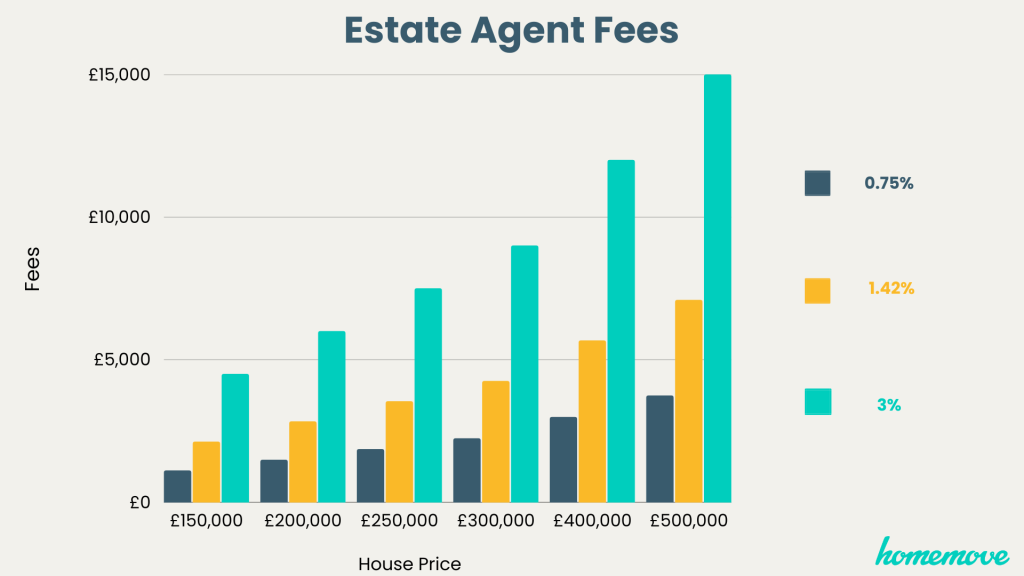

One of the most significant elements which will increase the cost of moving house in the UK is the fee that you will pay your estate agent. Estate agent fees are usually between 0.75% and 3.0% of the final sale price plus VAT. In 2022 the average fee was around 1.42% including VAT and the house price index shows that in June 2022, the average house price was £286,397. Therefore, the fee for an estate agent would be around £4,066. Estate agents will usually have no up front fees and work on a no sale, no fee basis.

Take a look below at the costs of estate agents fees for different house prices and according to different fee ranges.

What will be included in the price of an estate agent?

- Professional photography

- Writing a compelling description of your home

- Generating a good valuation

- For sale signs for local agents

- Negotiations with potential buyers

- Arranging and attending viewings

- Chasing solicitors, mortgage companies and the selling chain to ensure a quick and smooth transaction.

As you can see, there is a lot of admin involved and value created by a good estate agent. You can find the best estate agent in your area here at homemove. There is the option to use an online only estate agent which will keep the costs down however, less than 10% of people selling their homes use an online estate agent and they will often do the bare minimum. Online only agents tend to charge a fixed free upfront which doesn’t align them to selling your property – there is power in commission on success – incentive to work hard and sell the property.

Also, when it comes to doing the valuation for your home, an online agent may not be as reliable. They may not be local to your area so, they won’t have knowledge of your area and what price homes in your area achieve. You can read about the dangers of overpricing or under-pricing your home here. Therefore, you could end up selling your home for less than it’s worth which is a very real cost!

You may also have to conduct the viewings yourself, so you will need to be comfortable showing people around your home and getting it ready for viewings.

Overall, even though traditional high street estate agents may cost more than online agents, the service and benefits you get are usually better. They will have knowledge of your area and will help you throughout the process. A traditional high street agent is worth the cost you pay for it.

If you are looking for an estate agent, we can help at homemove find you an agent in your area. We have a panel of trusted agents ready to help you sell and move into your dream home.

Conveyancing fees

You will need a conveyancing solicitor to deal with all the legalities of selling your home. They deal with transferring property from seller to buyer, sorting out the contracts and transferring funds between seller and buyer. The cost is usually between £400 and £1500.

To find a conveyancing solicitor you can do some research online and look at reviews and star ratings. You can also ask your estate agent to recommend one.

EPC fees

When selling your home you must have an Energy Performance Certificate. An EPC is rated from A to G and tells you the efficiency of energy in your home. Your home may already have an EPC as they are valid for 10 years. However, if you don’t have one, you must make sure you get one as you can not sell your home without it. An EPC will usually cost you between £35 and £120, the average price is around £67.50. Not a significant cost to moving house, but one to consider nevertheless.

Removal costs

When you sell your home you will need to move your belongings out and if you are buying a new home as well as selling then you may need to hire a removal company to help you move your stuff into your new home. In 2022 if you move a distance of around 15 miles the average price is around £800 for a 3-bedroom home, but it can be around £420 to £1,800. The removal fees will depend on:

- The size of your home

- How accessible your home is

- The distance the removal company will have to travel with your belongings

- Whether or not they have to pack your belongings

- If you will need to be storing any items away

Some removal companies can also add extra costs so be sure to research into the company and ask how much they charge and if there will be any extras.

To save money do as much of the packing as you can yourself as a removal company will charge you more if they have to pack for you.

Mortgage fees

The cost of moving house can be influenced by the fees attached to your mortgage deal. You should get in touch with your mortgage company to let them know you will be selling your home. When you sell your home there might be a mortgage exit fee. This fee is the charged for closing down your mortgage account. The fee is usually around £50-£300.

If you are selling your home and buying a new one, you may be able to port your mortgage over, this means moving your mortgage over to your new home. Once you have sold your home, your conveyancing solicitor will use the money from the sale to pay off your remaining mortgage and you will start your new mortgage with the same lender.

If you are unable to port your mortgage then you may need to remortgage. This is when you move your mortgage from your old lender to a new mortgage lender. If you chose to move to a new lender then some of the costs involved in doing this are:

- Conveyancing fees

- The new lender may charge booking or completion fees

- Valuation fee

- Your current lender may charge an exit fee or early repayment charge

Preparing your property for sale

Before doing viewings you may want to do up your property. Sprucing up your property can add more value to your home and attract more buyers. To prepare for viewings some improvements that will cost are:

- Repainting rooms in your home

- Fixing broken sheds and fences

- Replace or fix broken windows

- Hiring a professional to clean your home

- Buying some flowers or hanging baskets

The list above is not essential, if you are looking to save money a good option is to try and do all the cleaning and fixing yourself rather than hiring professionals.

Survey

You may choose to get a RICS survey done on your home, a surveyor will look at the condition and structure of your home. A survey is a good idea if you want to find out about any problems with your home before you sell it.

A RICS survey can cost quite a lot depending on what level survey you have and the value of your property. A RICS home survey level 1 costs between £300 and £900. A level 2 survey will cost between £400 and £1000. The level 3 survey is the most expensive, as it is an in depth full structural survey, this will cost between £630 and £1500.

Having a RICS survey could be quite costly, because if the surveyor finds problems with your home you will either need to make the repairs to your home or during negotiations with a buyer take into consideration dropping the asking price in order for the buyer to make the necessary changes to your home.

Remember though that a RICS survey is not essential before you sell your home, so if you are looking to keep the costs down then you can choose not to get a survey done.

Summary

Taking into consideration the costs mentioned above, the cost of moving house is anywhere between £5,000 and £8,000. However, the cost could be lower or higher than this due to different things, from the size of your home to how you prepare it for sale. Now you know how much you need to budget for, you can take the next steps in selling your home.